As Bitcoin continues to mature, one of the most telling indicators of its longevity and integration into the broader financial ecosystem is the rapid growth of Bitcoin Exchange-Traded Funds (ETFs). These products—offering mainstream, regulated exposure to Bitcoin—have garnered substantial inflows from both institutional and retail investors since their inception. According to data aggregated by Bitcoin Magazine Pro’s Cumulative Bitcoin ETF Flows Chart, Bitcoin ETFs have already accumulated more than 936,830 BTC, raising the question: Will these holdings surpass 1 million BTC before 2025?

The #Bitcoin ETFs have already accumulated 936,830 #BTC! 🏦

Will this surpass 1,000,000 BTC before 2025? 🪙

Let me know 👇 pic.twitter.com/UojJpJlC4P

— Bitcoin Magazine Pro (@BitcoinMagPro) December 16, 2024

The Significance of the 1 Million BTC Mark

Crossing the 1 million BTC threshold would be more than a symbolic milestone. It would indicate profound market maturity and long-term confidence in Bitcoin as a credible, institutional-grade asset. Such a large amount of Bitcoin locked up in ETFs effectively tightens supply in the open market, setting the stage for what could be a powerful catalyst for upward price pressure. As fewer coins remain available on exchanges, the market’s long-term equilibrium shifts—potentially raising Bitcoin’s floor price and reducing downside volatility.

The Trend Is Your Friend: Record-Breaking Inflows

The momentum is undeniable. November 2024 saw record inflows into Bitcoin ETFs, surpassing $6.562 billion—over $1 billion more than the previous month’s figures. This wave of capital inflow dwarfs the rate of new Bitcoin creation. In November alone, just 13,500 BTC were mined, while more than 75,000 BTC flowed into ETFs—5.58 times the monthly supply. Such an imbalance underscores the scarcity dynamics now in play. When demand vastly outpaces supply, the natural market response is upward price pressure.

A Chart of Insatiable Demand

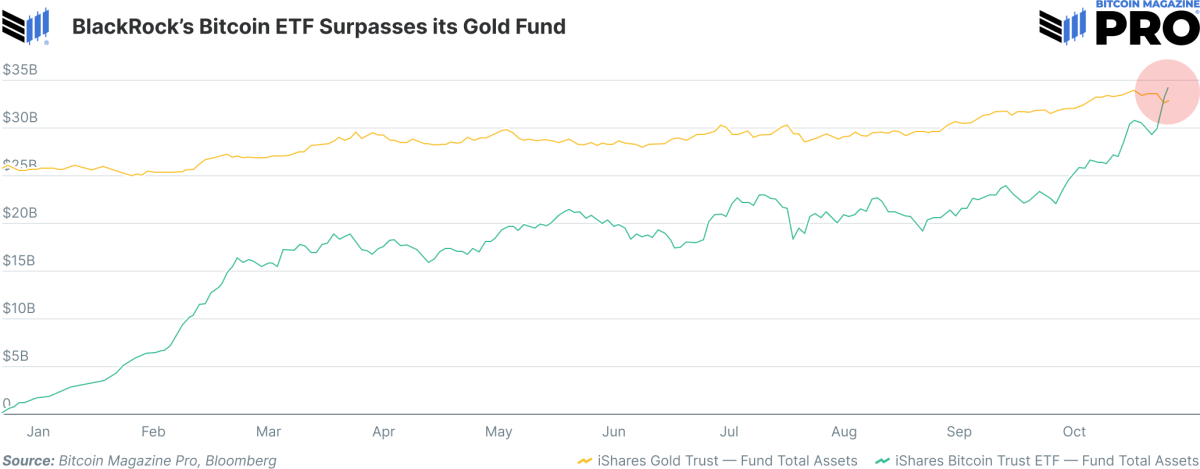

In a landmark moment, BlackRock’s Bitcoin ETF recently outpaced the company’s own iShares Gold Trust in total fund assets. This moment was captured visually in the November issue of The Bitcoin Report, revealing a clear shift in investor preference. For decades, gold sat atop the throne of “safe haven” assets. Today, Bitcoin’s emerging role as “digital gold” is validated by ever-growing institutional allocations. The appetite for Bitcoin-backed ETF products has become relentless, as both seasoned investors and new entrants acknowledge Bitcoin’s potential to serve as a cornerstone in diversified portfolios.

Long-Term Holding and Supply Shock

One key characteristic of Bitcoin ETF inflows is the long-term nature of these investments. Institutional buyers and long-term allocators are less likely to trade frequently. Instead, they acquire Bitcoin through ETFs and hold it for extended periods—years, if not decades. As this pattern continues, the Bitcoin held in ETFs becomes essentially removed from circulation. The result is a steady drip of supply leaving exchanges, pushing the market toward a potential supply shock.

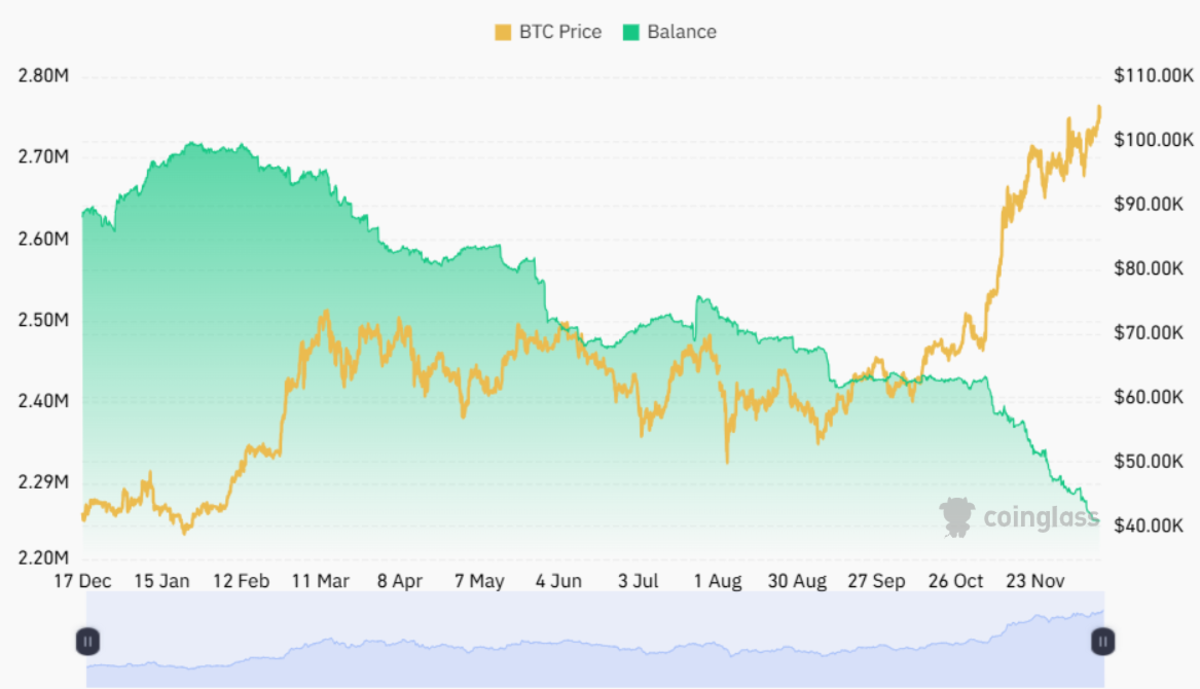

This trend is clearly illustrated by the latest data from Coinglass. Only about 2.25 million BTC currently remain on exchanges, highlighting a persistent decline in readily available supply. The chart below (provided separately) shows a divergence where Bitcoin’s price appreciation continues upward, while the exchange balances head down—an irrefutable signal of scarcity dynamics at work.

A Perfect Bitcoin Bull Storm and the March Toward $1 Million

These evolving dynamics have already propelled Bitcoin beyond the $100,000 milestone, and such achievements could soon feel like distant memories. As the market rationalizes a potential journey towards $1 million per BTC, what once seemed like a lofty dream now appears increasingly feasible. The “multiplier effect” in market psychology and price modeling suggests that once a large buyer comes into play, the ripple effects can cause explosive price surges. With ETFs continually accumulating, each major purchase may ignite a cascade of follow-on buying as investors fear missing out on the next leg up.

Incoming Trump Administration, the Bitcoin Act, and a U.S. Strategic Reserve

If current trends weren’t bullish enough, a new and potentially transformative scenario is brewing on the geopolitical stage. Incoming President-elect Donald Trump in 2025 has expressed support for the “Bitcoin Act,” a proposed bill directing the Treasury to establish a Strategic Bitcoin Reserve. The plan involves selling part of the U.S. government’s gold reserves to acquire 1 million BTC—about 5% of all currently available Bitcoin—and hold it for 20 years. Such a move would signal a seismic shift in U.S. monetary policy, placing Bitcoin on par with (or even ahead of) gold as a cornerstone of national wealth storage.

With ETFs already driving scarcity, a U.S. governmental move to secure a large strategic Bitcoin reserve would magnify these effects. Consider that only 2.25 million BTC are available on exchanges today. Should the United States aim to acquire nearly half of that in a relatively short timeframe, the supply-demand imbalances would become extraordinary. This scenario could unleash a hyper-bullish mania, pushing Bitcoin’s price into previously unthinkable territory. At that point, even $1 million per BTC might be viewed as rational, a natural extension of the asset’s role in global finance and national strategic reserves.

Conclusion: A Confluence of Bullish Forces

From near-term ETF inflows surpassing new issuance fivefold, to longer-term structural shifts like a potential U.S. Bitcoin reserve, the fundamentals are stacking in Bitcoin’s favor. The growing scarcity, combined with the multiplier effect of large buyers entering the market, sets the stage for exponential price appreciation. What was once considered unrealistic—a Bitcoin price of $1 million—now sits within the realm of possibility, underscored by tangible data and powerful economic forces at play.

The journey from today’s levels to a new era of Bitcoin price discovery involves more than just speculation. It’s supported by a tightening supply, unyielding demand, rising institutional acceptance, and even the potential imprimatur of the world’s largest economy. Against this backdrop, surpassing 1 million BTC in ETF holdings before 2025 may be just the beginning of a much larger story—one that could reshape global finance and reimagine the very concept of a reserve asset.

For the latest insights on Bitcoin ETF data, monthly inflows, and evolving market dynamics, explore Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.