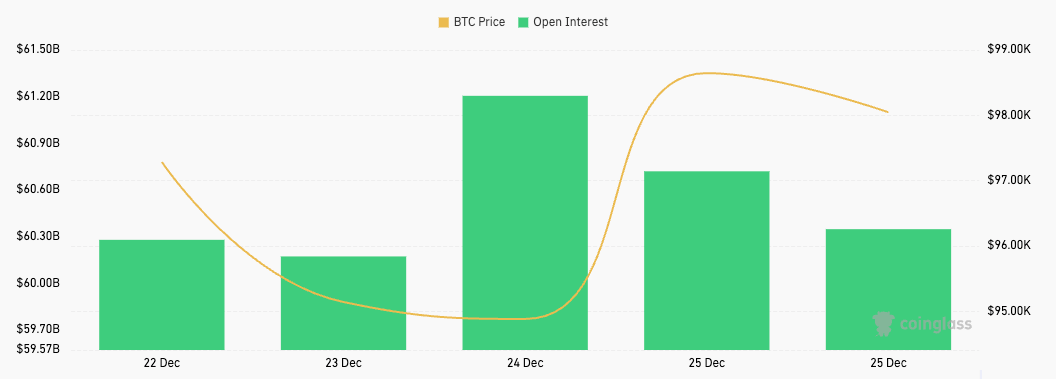

The holiday spirit failed to bring any stability to the crypto market, with Bitcoin seeing its price drop from $97,300 on Dec. 22 to $94,800 on Dec. 24. Christmas Day saw a slight recovery, but Bitcoin consolidated back to $98,000 as it met significant resistance above $99,000.

This price volatility was accompanied by equal volatility in the derivatives market. The futures market maintained relatively stable open interest, ranging from $60 billion to $61 billion during the same period, with a decline from $61.21 billion to $60.35 billion on Dec. 25.

This decrease in futures OI alongside rising prices suggests that traders are closing out leveraged long positions to take profits and reduce their appetite for leverage as the price increases. The timing of this drop in OI, occurring above the psychological $98,000 level, shows profit-taking and de-risking by leveraged traders.

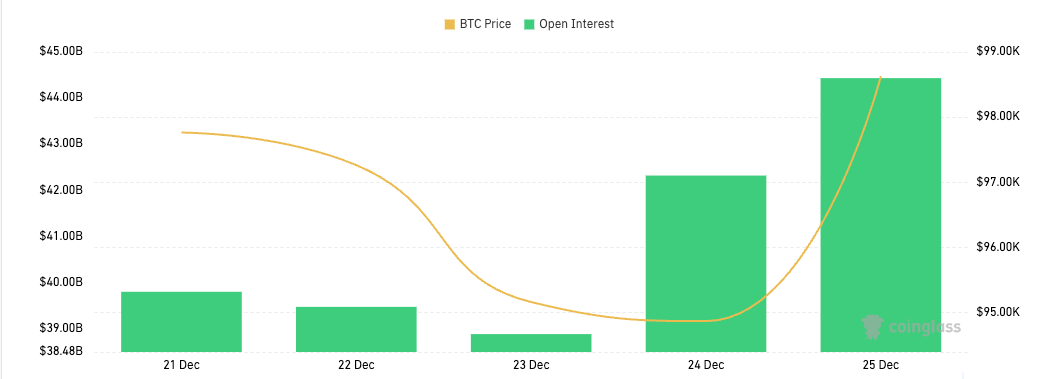

In contrast, the options market has shown quite a bit of strength in the past several days, with OI increasing from $39.47 billion to $44.43 billion, representing a 12.6% rise. CoinGlass data shows options sentiment leans decidedly bullish, with calls dominating both open interest (63.58% versus 36.42% puts) and volume (57.22% versus 42.78% puts). This distribution of options positioning strongly suggests traders are anticipating further upside potential.

The divergence between futures and options OI indicates a change in market risk appetite. Rather than representing pure deleveraging, this shift suggests traders are becoming more nuanced in their approach to market exposure. Data shows traders are slowly moving away from high-leverage, unlimited-risk futures positions in favor of defined-risk options strategies that offer similar exposure potential with superior risk management. This behavior is especially notable at higher price levels, where downside risk becomes more pronounced.

Professional traders are the ones driving these market shifts as they typically prefer options for precise risk management and position sizing with exact maximum loss parameters. The growth in options activity, particularly with complex strategies like spreads and straddles, indicates increasing institutional participation and overall market maturation. And while the futures market is still significantly larger than options, the growth we’ve seen in options shows traders are developing more advanced risk management strategies as the market infrastructure improves.

This has important implications for price and liquidity. With less direct liquidation risk from futures and more gamma-driven price action from options, we may see slower, more controlled upward moves, though sharp price movements remain possible if key strike prices are breached. The shift also affects market depth, with futures markets potentially showing reduced liquidity while options market makers take on larger roles, leading to more complex hedging flows in the spot market.

Despite the generally healthy market indicators, there are always risks. The high absolute levels of both futures ($60+ billion) and options ($44+ billion) open interest indicate significant market participation, which means potential for volatility. The call-heavy positioning could accelerate upside moves and create the risk of sharp unwinding if the price drops.

The post Bitcoin options OI hits $44B as futures trading cools appeared first on CryptoSlate.