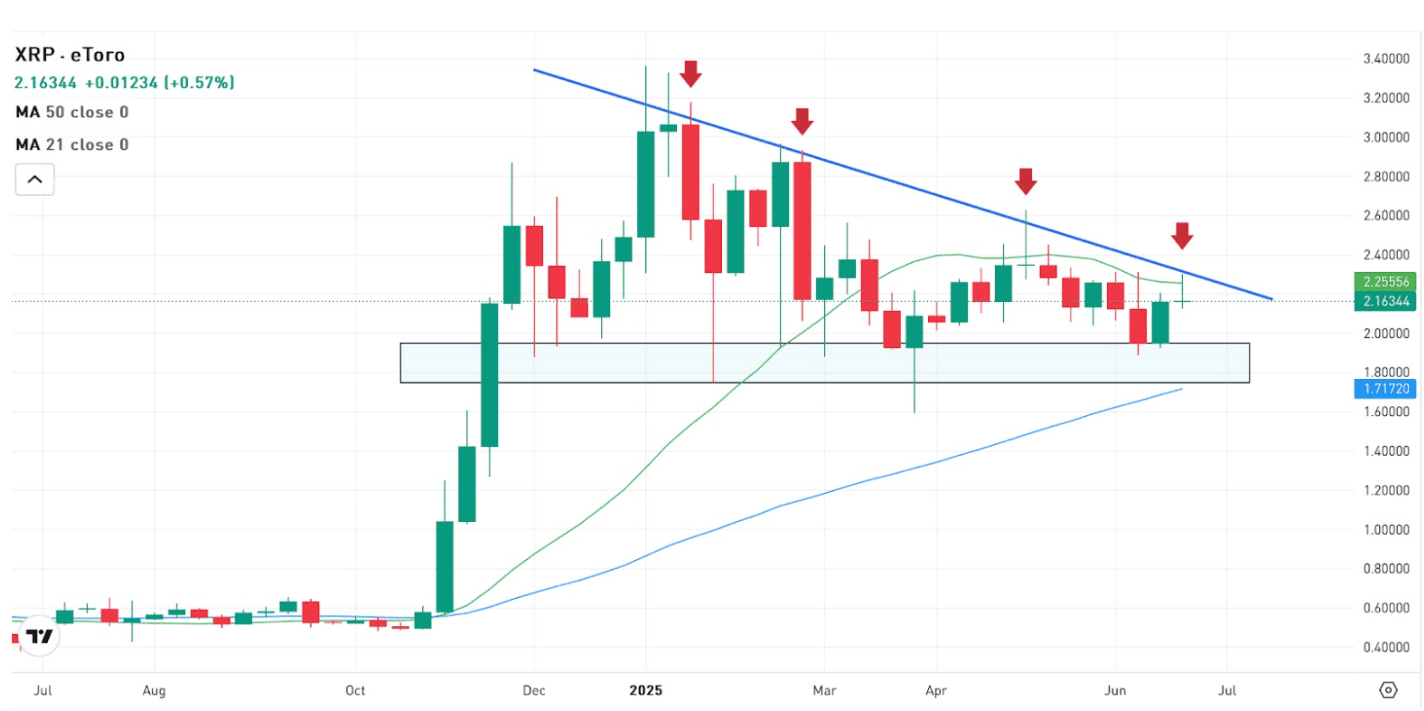

The Waves protocol (WAVES) value has remained in a channel towards Tether (USDT) because it makes an attempt to interrupt out of this pattern. Regardless of the current shift available in the market pattern, Waves protocol (WAVES) has proven little to no vital motion, as many altcoins rallied and produced double-digit positive factors. (Binance knowledge)

The Weekly Chart Evaluation For WAVES Protocol (WAVES)

In accordance with the chart, WAVES hit a weekly low of $4.2, then bounced again to $5. Contemplating its all-time excessive of greater than $60, this isn’t a lot of a motion.

The weekly candle for WAVES closed with a bearish sentiment, whereas the brand new week’s candle seems bullish for value restoration.

The worth has struggled to achieve traction because it makes an attempt to interrupt out of the $4-$6.3 value vary.

If the weekly chart of WAVES maintains this construction, it may shortly return to its low of $4, appearing as help. WAVES should keep this help zone to keep away from falling under.

Weekly resistance for the worth of WAVES – $6.3.

Weekly help for the worth of WAVES – $4.

Day by day (1D) WAVES Value Chart Evaluation

With extra purchase orders, WAVES value may break to the upside after forming a spread in a channel; a breakout and retest above $6.3 would point out a continuation of the uptrend.

The worth should escape with enough quantity to type help above the ranging channel to substantiate bullish sentiment.

WAVES value has proven a slight bullish construction, ranging in a channel; if bulls step in, WAVES’ value may pattern increased to a area of $10, appearing as key resistance on the every day timeframe.

WAVES is at present buying and selling at $5.1, slightly below the 50 Exponential Transferring Common (EMA) of $5.7.

The Relative Energy Index (RSI) on the every day chart is above 40, indicating minimal purchase orders.

Day by day (1D) resistance for WAVES value – $6.3.

Day by day (1D) help for WAVES value – $4.3.

Value Evaluation The 4-Hourly (4H) Chart

The worth of WAVES has continued to battle under the 50 and 200 EMA costs, which correspond to $5.1 and $5.5, appearing as resistance, respectively.

WAVES wants to interrupt above the 50 and 200 EMA to imagine a bullish sentiment; If WAVES fails to interrupt and maintain above the costs of $5.1 and $5.5, appearing as a resistance degree, the worth of WAVES might retest the $4 help ranges.

The 4H quantity exhibits extra promote orders and buys orders wanted to push the worth out of the vary.

With the use case of WAVES, it may do effectively over time.

4 Hourly (4H) resistance for WAVES value – $5.1, $5.5.

4 Hourly (4H) help for WAVES value – $4.

Featured Picture From zipmex, Charts From TradingView.com