Following the Financial institution of England explaining that it could be meddling in U.Ok. bond markets and the Financial institution of Japan defending the yen within the international trade market final week, the Hong Kong Financial Authority (HKMA) revealed it intervened in foreign exchange markets on Wednesday. Hong Kong’s central financial institution detailed that it interfered in foreign exchange markets with a view to defend the Hong Kong greenback (HKD) because it confirmed indicators of weak point in opposition to the dollar on September 28.

HKMA Interferes in Foreign exchange Markets to Defend the HKD From Capital Flight to USD Property

Whereas the euro and pound sterling misplaced 12-17% in opposition to the U.S. greenback over the past six months, there’s been a big quantity of capital flight to the dollar. The Hong Kong greenback (HKD), nevertheless, has fared higher than a myriad of fiat currencies worldwide in opposition to the U.S. greenback.

On Wednesday, September 28, reviews element {that a} “flight of capital from the Hong Kong greenback market” pushed the HKMA to step in and defend the HKD in foreign exchange markets. South China Morning Put up (SCMP) reporter Enoch Yiu defined on Wednesday that the HKMA mentioned it intervened with a view to “assist the peg after the native foreign money hit the weaker finish of its HK$7.75 to HK$7.85 buying and selling band.”

SCMP particulars that it’s the primary time in seven weeks the central financial institution defended the HKD on this vogue and the HKMA has chosen to intervene within the international trade market 32 occasions this 12 months. Yr-to-date, the HKD/USD trade price is down 0.83% and the de facto central financial institution has bought HK$215 billion this 12 months.

The authority offered roughly $27.39 billion USD in 2022 and up to date reviews element that the central financial institution has bought native {dollars} “at a document tempo to defend the town’s foreign money peg.” Moreover, as Hong Kong and Japan not too long ago tampered within the foreign exchange enviornment, India, Chile, South Korea, and Ghana have additionally defended their currencies in international trade markets.

Hong Kong’s transfer to defend the native greenback follows the HKMA, Indonesia, and the Philippines elevating benchmark financial institution charges following the USA Fed’s latest price hike on September 22. On the time, the HKMA hiked the speed by 75 foundation factors (bps) bringing the lending price to three.5%.

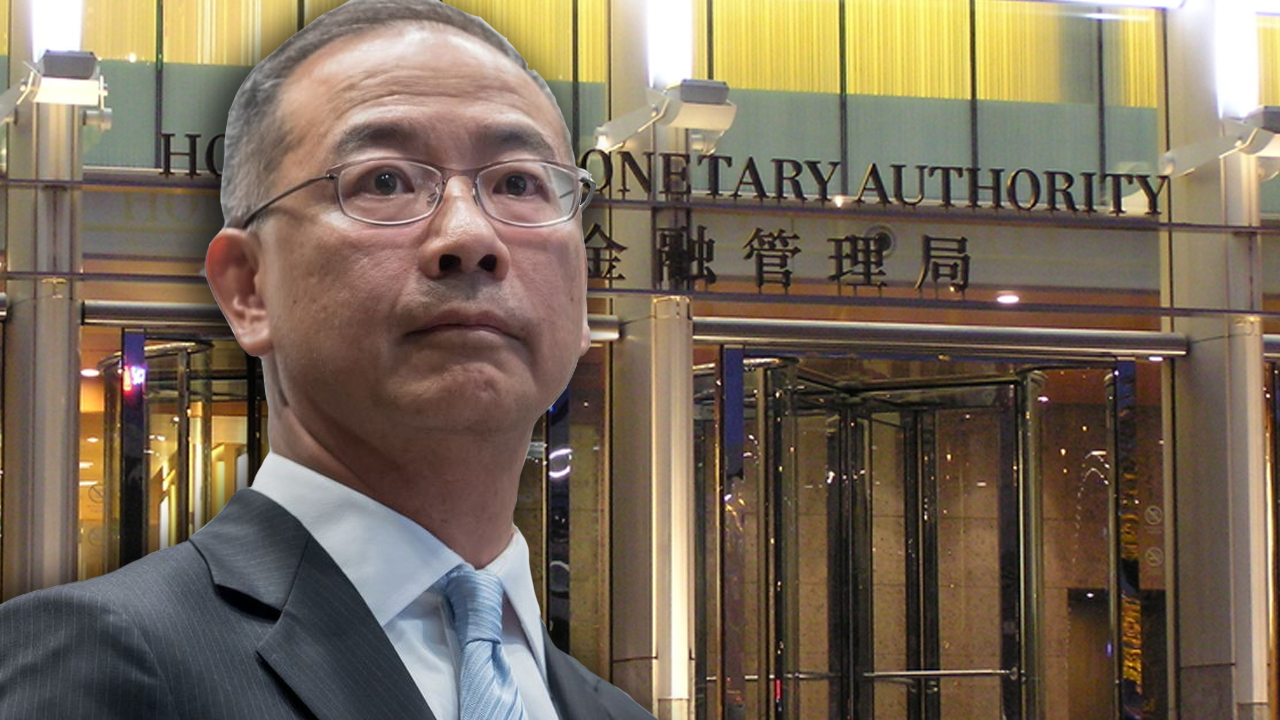

The third and present chief govt of the HKMA, Eddie Yue, detailed that he didn’t see a significant danger to the territory’s housing market. “The newest price on unhealthy debt is about 1% and will regulate upward just a little bit. However it’s nonetheless low as in comparison with some worldwide ranges,” Yue remarked final week.

What do you consider the HKMA stepping in to intervene in foreign exchange markets with a view to defend the HKD? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.