The Bitcoin mining trade has grown tremendously in the previous couple of years. With a number of bull markets up to now, there was a big revenue margin for many who have gone down this route, with corporations making a whole bunch of tens of millions of {dollars} off their operations. The bear market has had a profound influence on the bitcoin mining trade however it has not scared off members, and now Binance is offering assist for miners.

$500 Million For Bitcoin Mining

On Friday, Binance introduced that it was launching a $500 million pool for bitcoin miners. It supplies a line of credit score for as much as $500 million for miners who’re searching for capital for his or her mining operations. The crypto alternate mentioned that this was in an effort “to assist preserve a wholesome digital asset ecosystem.”

This fund comes at a time when the crypto mining trade is beneath strain as the price of manufacturing is excessive sufficient that revenue margins are being diminished. Many bitcoin miners are prone to going bankrupt and having to close down their operations.

The loans from the Binance fund will probably be topic to phrases & circumstances similar to rates of interest ranging between 5-10% and an 18 to 24-month time period. Debtors can even have to offer some kind of safety for the loans.

BTC worth trending at $19,600 | Supply: BTCUSD on TradingView.com

As well as, Binance can be searching for cloud mining distributors to companion with. This goes consistent with the cloud mining merchandise that the crypto alternate says it plans to launch.

Mining Turns into More durable

Declining market costs should not the one factor that bitcoin miners are at the moment battling with. Given how worthwhile the trade might be, there have been extra gamers coming into the sphere and this has made it harder to run worthwhile mining.

The doorway of latest mining machines into the market has elevated the hash price drastically and the problem has shot up in consequence. Earlier this week, the bitcoin community noticed its largest issue adjustment for the 12 months 2022 when it elevated by 13.5%. Because of this it now requires the next hash price to mine a single block.

Miners will now have to extend their hash price to have a aggressive benefit and loans similar to those being supplied by the Binance fund will assist miners hold their operations going. The loans are additionally not relegated to a selected group as each private and non-private bitcoin miners and digital asset infrastructure corporations will be capable of partake.

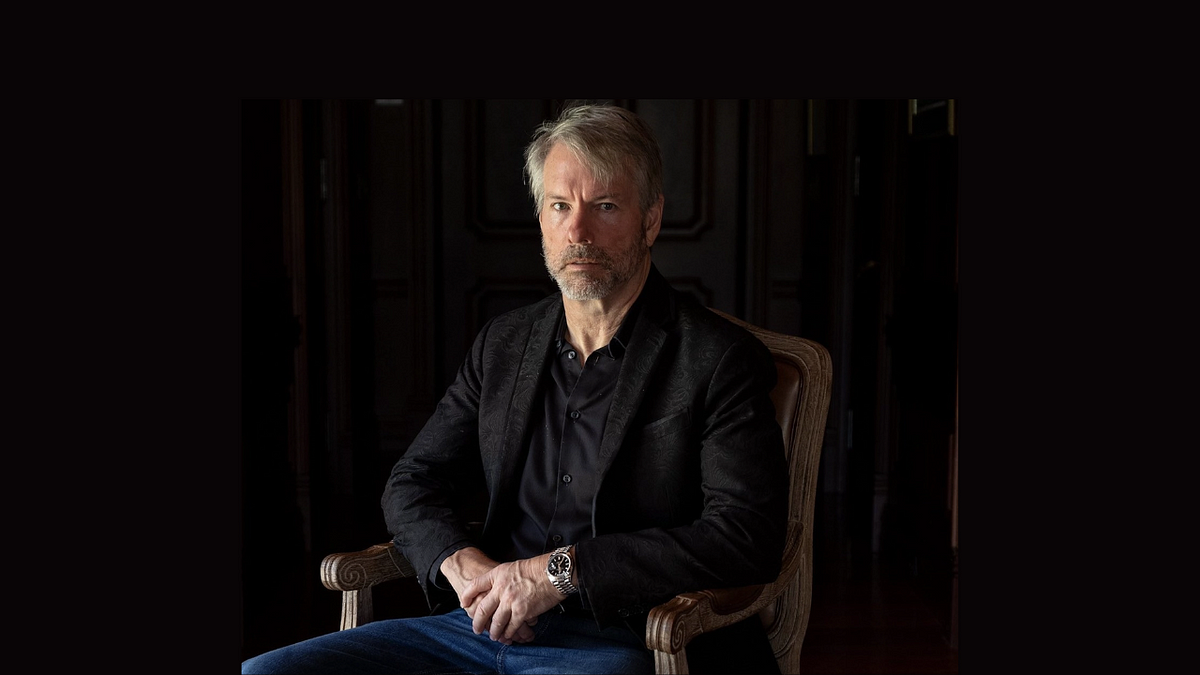

Featured picture from The Instances, chart from TradingView.com

Observe Best Owie on Twitter for market insights, updates, and the occasional humorous tweet…