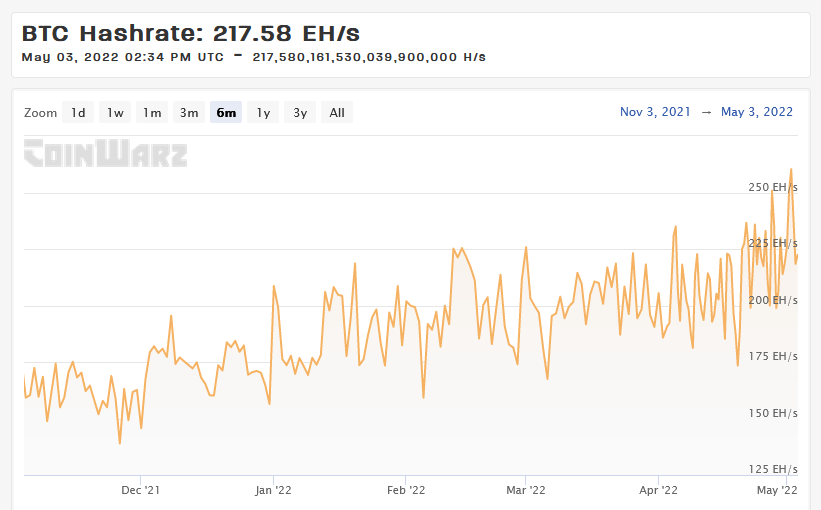

CoinWarz reveals the Bitcoin hash fee continues to blow up, hitting a brand new all-time excessive of 270 EH/s on Monday earlier than settling across the 220 EH/s at present.

A rising Bitcoin hash fee signifies the variety of miners on the community is rising. That is typically taken as a measure of rising miners’ confidence in BTC.

Nonetheless, contemplating the looming menace of recession, some even say melancholy, do the miners know one thing we don’t?

Recession indicator flashes purple

Satoshi Nakamoto created Bitcoin following the 2008 recession to handle central financial institution foreign money debasement and create an alternative choice to the banking system.

As an alternative choice to TradFi, some assumed Bitcoin would act as a risk-off asset. But current information from Bloomberg reveals the correlation between the Nasdaq and BTC has by no means been larger. This implies bother forward for crypto as shares sink throughout recessions.

How probably is a recession? An often-used indicator of recession is the yield curve. Sometimes, long-term debt devices pay larger yields than short-term debt because of the elevated threat of lending over the long term.

An inverted yield curve, the place long-term debt pays much less yield than short-term debt, is a robust indicator of a pending recession. Since 1955, a recession adopted all situations of an inverted yield curve besides one.

In late March 2022, the unfold between the 2 and ten-year US authorities bonds tightened to only 0.2%. A continuation of this pattern will result in the yield curve inverting.

The financial outlook is unfavorable with different components in play, similar to pending US rate of interest raises and battle in Jap Europe.

Nonetheless, the rising BTC hash fee suggests miners count on the value of Bitcoin to go up, counter to what’s anticipated contemplating the state of the macroeconomic panorama.

What’s the connection between Bitcoin hash fee and value?

There may be debate concerning the connection between the Bitcoin hash fee and its value.

On-chain Analyst Willy Woo argues that Bitcoin’s value follows the hash fee. This line of considering contends {that a} rising hash fee, as we’re witnessing now, will result in the BTC value rising.

Nonetheless, others imagine the hash fee follows value, in that it’s the value that drives miners to need to spend money on costly mining gear.

Since November 2021, the value of Bitcoin has been trending downwards, but over this era, the hash fee has been rising. This relationship counts towards the concept the hash fee follows value as a result of a falling value would see a drop within the hash fee, which isn’t the case.

However then once more, this sample additionally runs opposite to the notion that value follows hash fee as a result of if this had been true, then the rising hash charges that we’re seeing now would equate to the Bitcoin value transferring larger.

The one conclusion to attract presently is that the correlation between the hash fee and the value is weak.