Analysts forecast a year-over-year improve of 6.5% within the U.S. Shopper Worth Index (CPI) for December 2022 — with the Bureau of Labor Statistics’ official knowledge releasing Jan. 12 — however 2023 may convey some upside as investor Michael Burry expects CPI to maneuver decrease this 12 months however warned that any subsequent pivot on rates of interest to stimulate financial exercise would set off a second inflationary spike.

November 2022’s precise CPI got here in at 7.1%, lower than the forecasted 7.3% fee. The higher-than-expected consequence led to a bounce in crypto costs through the announcement, with Bitcoin posting a right away spike to $18,000 on the time.

All through this bear market, CPI knowledge and rate of interest bulletins have been important catalysts to crypto value volatility earlier than, after, and through bulletins. However to what extent?

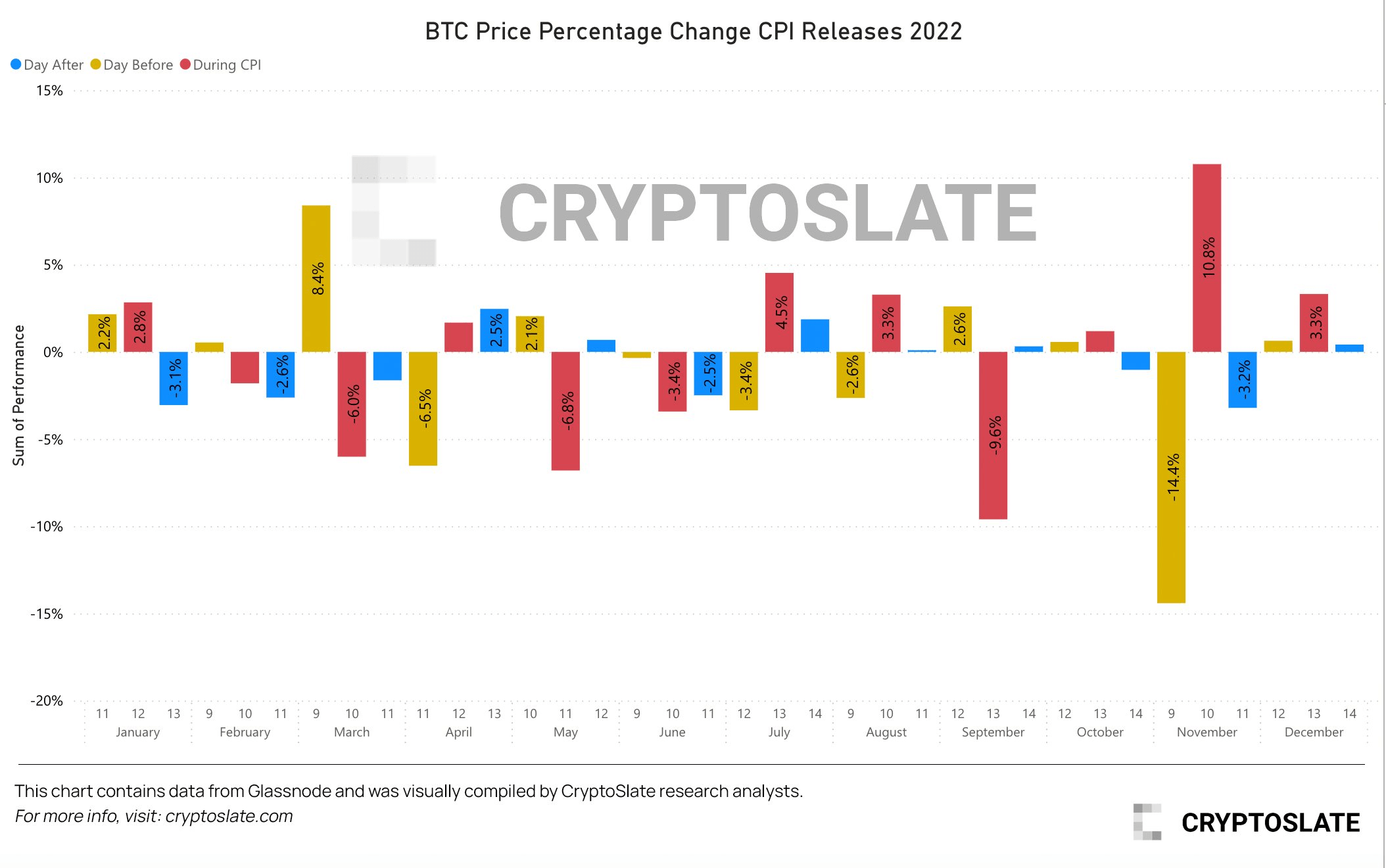

The chart under reveals roughly half optimistic and half adversarial results on the Bitcoin value earlier than the CPI announcement; this was additionally the case through the announcement.

In contrast, the day after the announcement tended to yield largely adversarial value results, presumably as buyers have had time to soak up the truth of elevated client costs and the following continuation of rate of interest hikes.

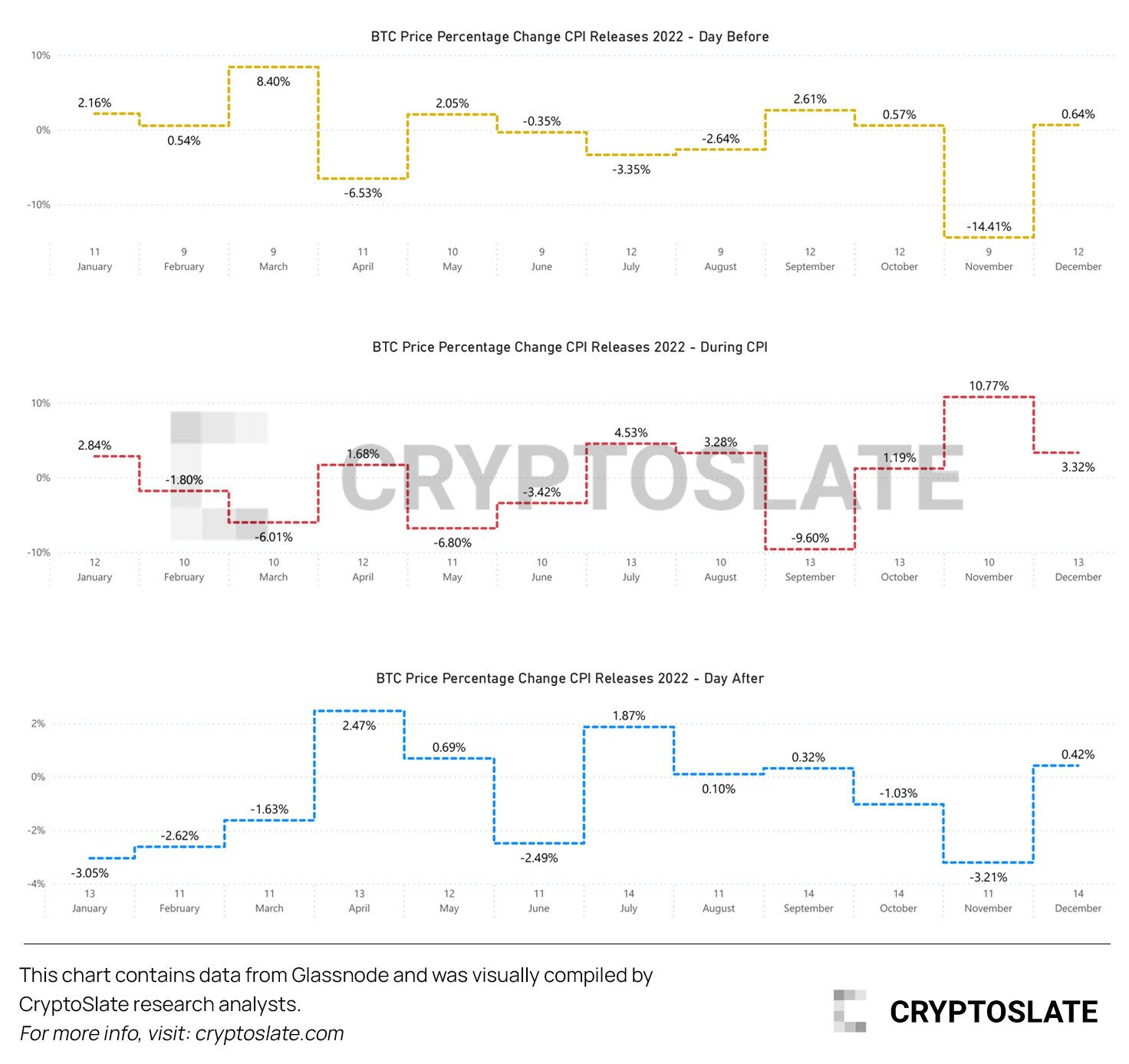

Separating the three classes of “Day Earlier than, “Throughout CPI,” and “Day After” into particular person share change charts higher depicts the beforehand said findings.

Primarily based on these patterns, there isn’t any important directional probability both earlier than or through the CPI announcement. Nevertheless, it’s anticipated that Bitcoin will development decrease post-announcement.

Rising indicators of stagflation

There may be rising proof of stagflation, regardless of denials of a recession nowadays, together with the White Home redefinition of what constitutes a recession.

Stagflation refers to a mixture of excessive inflation and financial stagnation, notably excessive unemployment. This presents policymakers with a dilemma, in that measures to decrease inflation may irritate unemployment.

A current article by Peter Schiff blamed our present financial woes on “these stimmy checks” triggering inflation, which has since morphed into stagflation. He identified that authorities spending, a method or one other, should be paid for by the general public.

Additional, quoting work by Spanish Economist Daniel Lacalle, the article talked about the truth of weaker progress traits, rising taxes, and extreme inflation, notably in respect of power costs.

The final time issues regarded this bleak was through the stagflation of the Seventies. This decade was characterised by weak financial progress, excessive unemployment, and double-digit inflation.

A repeat of the Seventies?

Burry lately tweeted:

“Inflation peaked. However it isn’t the final peak of this cycle. We’re more likely to see CPI decrease, presumably unfavourable in 2H 2023, and the US in recession by any definition. Fed will lower and authorities will stimulate. And we may have one other inflation spike. It’s not exhausting.“

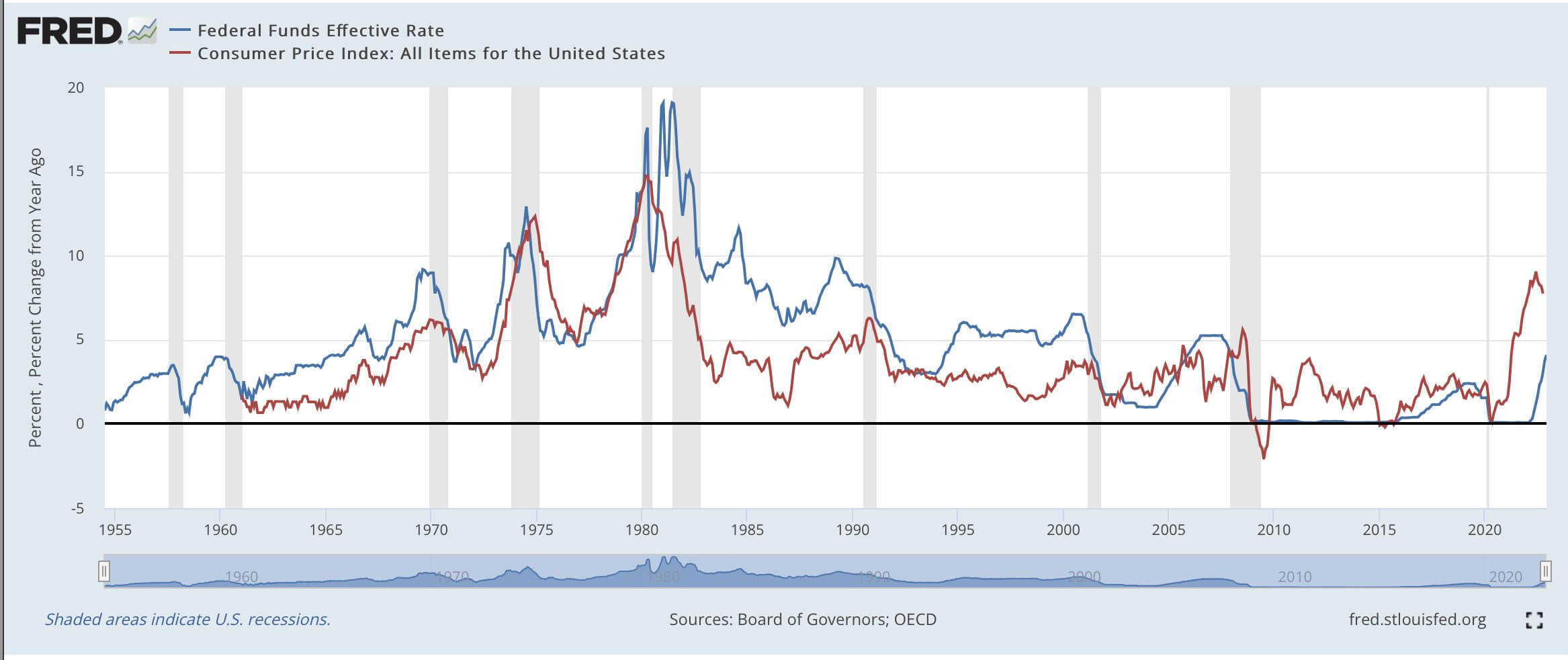

The state of affairs described by Burry occurred on three events through the Seventies. The chart under reveals these three distinct inflationary waves peaking after which receding over the course of the last decade.

It wasn’t till Paul Volcker, Fed President between 1975 and 1979, pushed for a funds fee above CPI that spiking client costs lastly got here beneath management.

Drawing on this, investor Invoice Druckenmiller lately identified that after inflation exceeds 5%, it has by no means retreated till the Fed funds fee was taken above it, which begs the query, why are rates of interest not at 9%?

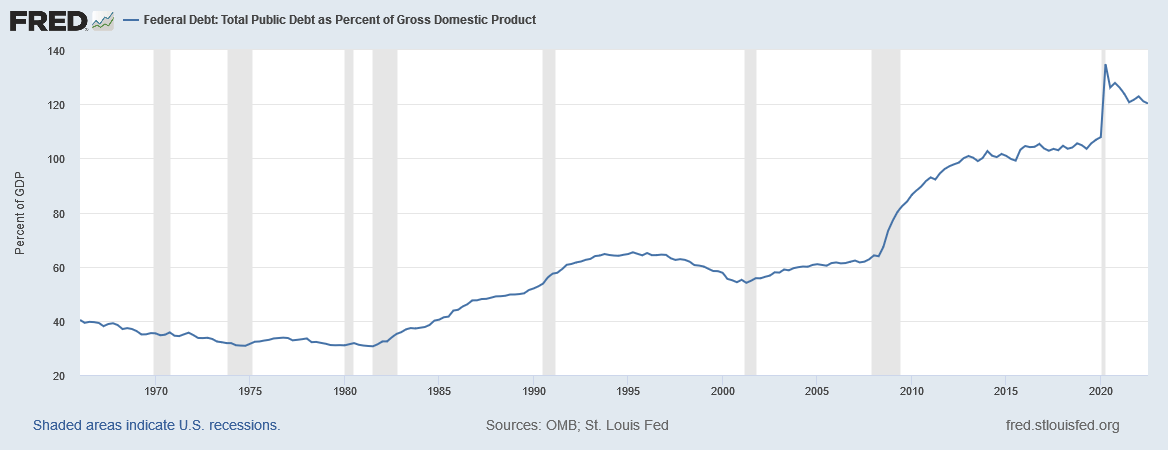

In the course of the Seventies, debt to GDP ranged between 30% and 35%, enabling Volcker leeway for taking charges as excessive as 19%. Now, with a debt to GDP of 120%, taking rates of interest above CPI inflation would destroy the financial system.

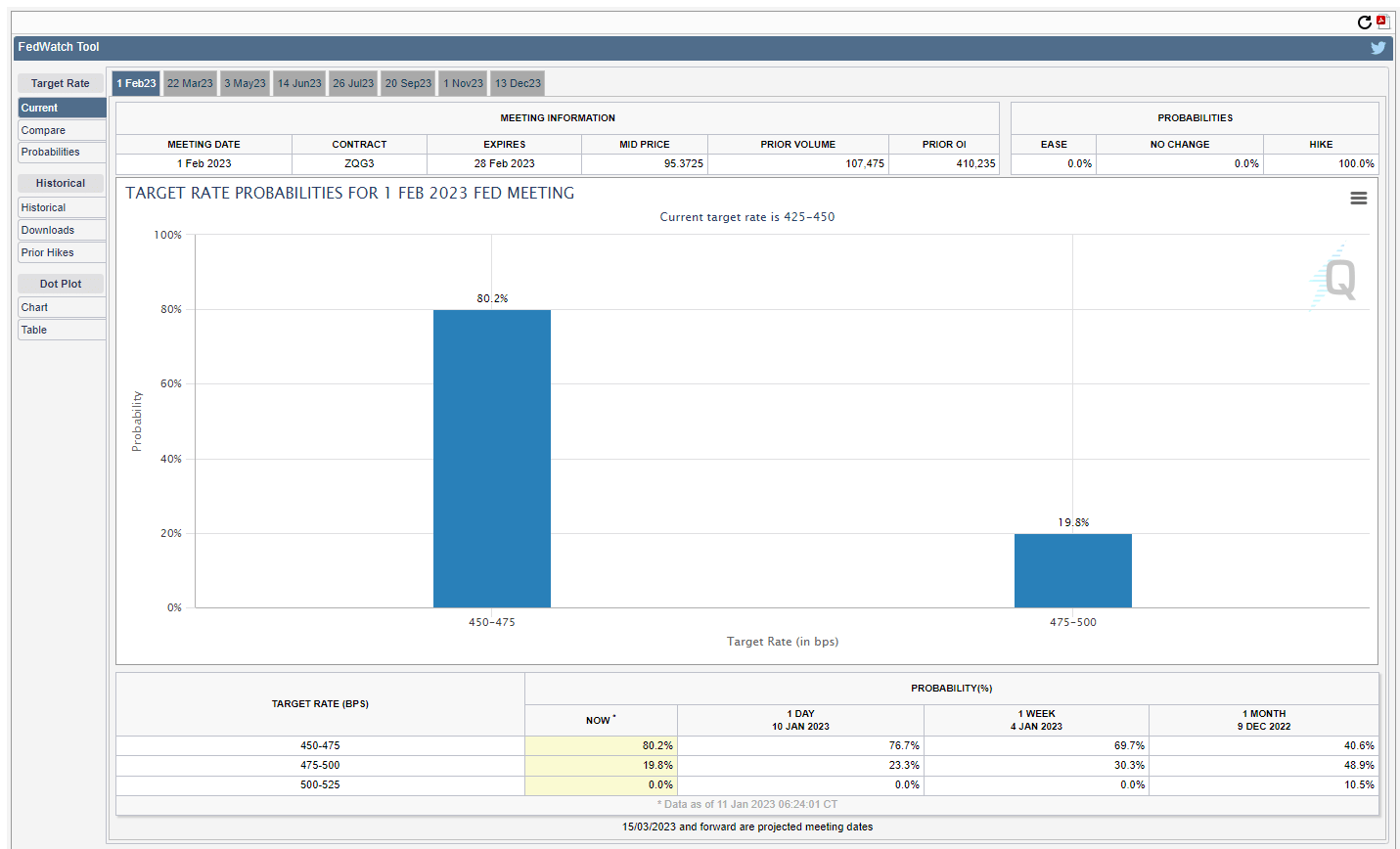

The subsequent FOMC assembly is because of conclude on Feb. 1. At present, analysts are 4/1 in favor of a 25 foundation level hike, supporting the narrative {that a} slowdown within the tempo of fee hikes is enjoying out.

Nonetheless, earlier feedback by Fed Chair Jerome Powell, wherein he spoke of charges “increased for longer,” recommend, regardless of a slowdown in tempo, now we have but to succeed in the terminal fee. Equally, there isn’t any indication of how lengthy the Fed intends to remain on the terminal fee as soon as it has been reached.

No matter Burry’s prediction, from the present perspective, a pivot appears a good distance away, retaining stress on danger property, together with Bitcoin, right now.