[ad_1]

The beneath is a direct excerpt of Marty’s Bent Subject #1217: “Q1 Financial Base replace.” Join the e-newsletter right here.

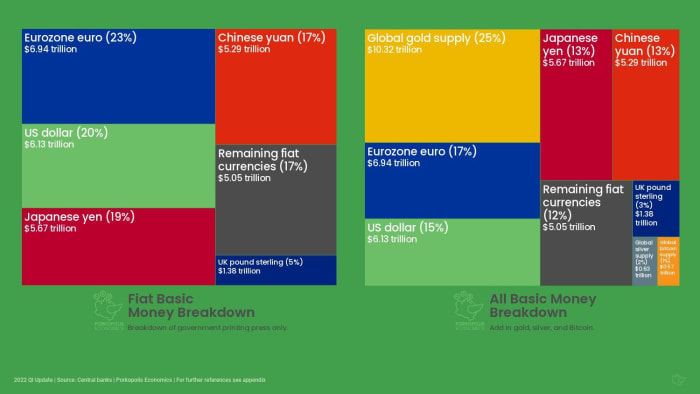

by way of Porkopolis Economics

by way of Porkopolis Economics

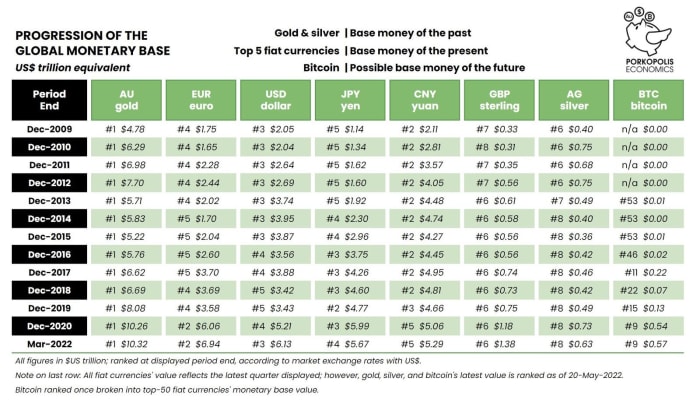

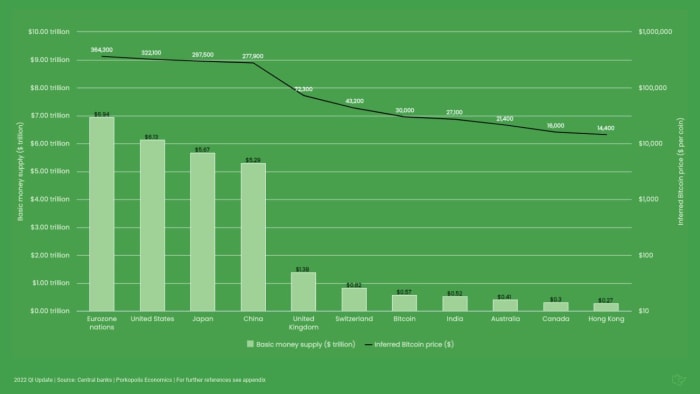

Matthew Mežinskis has gifted us with one more international financial base replace. As of the tip of Q1 2022, bitcoin ranks because the ninth largest base cash on this planet (together with gold and silver). That is two spots decrease than it was after Q3 2021, when bitcoin was the seventh largest base cash on this planet and buying and selling at an all-time excessive. A stumbling down the record should not be stunning after an approximate 25% decline from that all-time excessive by the tip of March 2021. If the worth of bitcoin stays above $27,100 between now and June 30, 2022, the nascent asset ought to retain its spot at ninth place on these charts. If it falls beneath that value (as of Might 20, 2022, when the report was printed) the Australian cuckbuck will take its spot.

by way of Porkopolis Economics

Regardless of latest value declines, bitcoin finds itself in a really robust place when in comparison with the opposite base monies of the world. It is holding regular behind the Swiss franc and the British pound. Many might level at bitcoin falling again down the record and use it as a “gotcha!” second to verify their biases that bitcoin won’t ever change into the reserve foreign money of the world. Nonetheless, for those who take one other peep on the chart on the high of this rag you will see that this is not irregular for the longer term reserve foreign money of the world. It makes big, orders of magnitude leaps up the record then cools down for a bit.

If you happen to take a look at the chart above you will see that bitcoin is just one or two orders of magnitude jumps in value from turning into the biggest base cash on the planet. It’s approaching the highest 5 of the pack, which dominates the pareto distribution of world base monies. That is a particularly spectacular feat for an alien financial know-how that was dropped on humanity just a little over 13 years in the past.

These orders of magnitude strikes from bitcoin may be visualized in different methods. I am positive you’ve got heard the thought of “decoupling” talked about infrequently. Many state that there can be a day sooner or later sooner or later when bitcoin fully “decouples” from equities markets and stops buying and selling in lockstep with the asset class. The truth of the state of affairs is, bitcoin decoupled from equities way back.

Sure, bitcoin could also be very correlated to shares and different property over a brief or medium time horizon, however, as you may see from the BTC/NASDAQ ration chart above shared by Tuur Demeester, bitcoin makes large, orders of magnitude jumps in very brief durations of time throughout large rallies. And has continued the development of repeating this up-and-to-the-right for the reason that protocol was launched in 2009.

If the demand for a particularly scarce financial bearer asset that may be self-custodied with relative ease and transferred and secured by a globally distributed community of nodes operating open-source software program will increase, you may count on this development to proceed. Once you go searching at every little thing happening on this planet, significantly with governments trying to clamp down on liberties as they lose management of the financial, meals and power techniques, betting that the demand for bitcoin is not going to solely improve, however improve considerably looks as if a really low danger guess.

[ad_2]

Source link