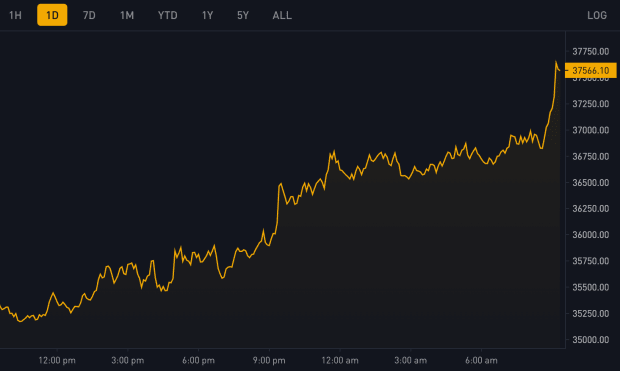

Shares of U.S. crypto-centric firms ticked upward in pre-market buying and selling, driving the momentum of the newest rally in BTC and reflecting the contemporary optimism of a spot bitcoin ETF lastly being accredited within the U.S. Coinbase was up about 4% as of round 6.00 ET, whereas MicroStrategy, the software program developer that holds over 150,000 BTC on its stability sheet, rose virtually 5%. Mining companies Marathon and Riot superior round 9.8% and 6% respectively. Robinhood confirmed extra restrained features of two.5%, having dropped 14% on Wednesday after reporting large drops in its income and buying and selling exercise.