Utilizing the POWR Choices method to extend returns at decrease threat in iron ore mining mammoth Rio Tinto (RIO).

Possibility buying and selling may be befuddling to many. Little question that a few of the intricate methods utilized by hedge funds and large banks may be each complicated and daunting.

Fortunately, there are less complicated and extra easy methods to commerce choices that the typical retail investor can use to each decrease the danger and upfront value and improve potential returns.

These are precisely the kind of trades we make use of within the POWR Choices program. We mix the POWR Scores together with technical and volatility evaluation to pick the perfect shares to purchase bullish calls together with discovering the worst shares to purchase bearish places.

A stroll by means of the newest closed out commerce in RIO will assist shed some gentle on the method.

For these unfamiliar with Rio Tinto (RIO) inventory, it’s the world’s second largest mining firm. The first focus is on iron ore.

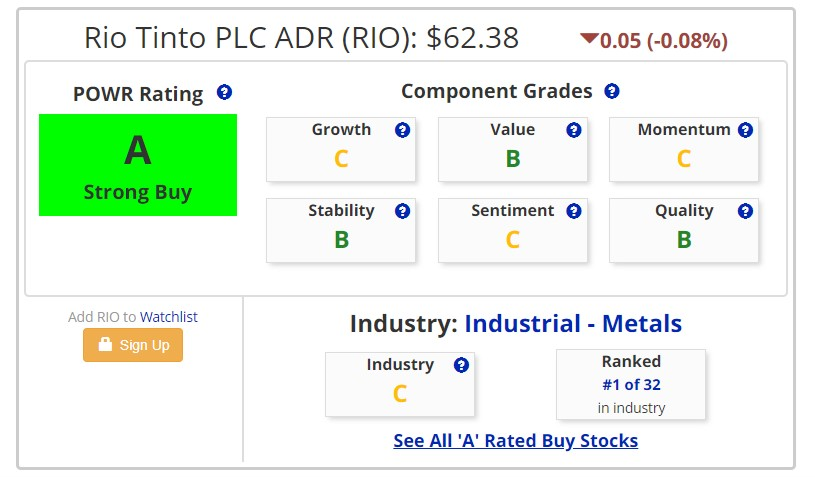

POWR Score

Rio Tinto was a Robust Purchase (A-Rated) inventory within the POWR Scores. Three Purchase Part Grades. Ranked on the very prime at #1 within the Industrial Metals Trade. Greatest metal inventory to purchase.

Technicals

RIO had bounced as soon as once more of main help on the $60 degree after nearing oversold readings as soon as once more. Shares had been poised to interrupt previous the 20-day transferring common and MACD was on the verge of producing a contemporary new purchase sign.

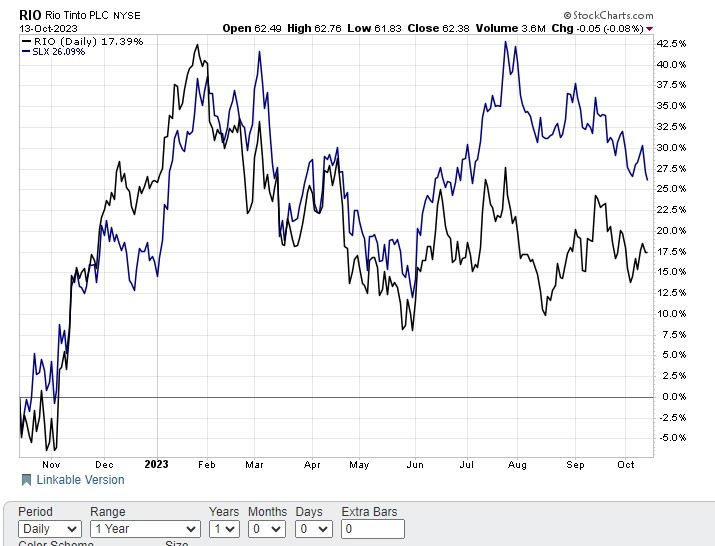

RIO Inventory was additionally buying and selling at an enormous low cost to the Metal Index (SLX). Usually the 2 are extremely correlated as seen within the comparative chart under. This is sensible given RIO is the biggest part of the Metal Index at 13% weighting.

Implied Volatility (IV)

Implied volatility (IV) was additionally buying and selling under common on the 38th percentile. This implies choice costs had been comparatively low cost. Much more so on condition that the VIX on the time of commerce inception on October 16 was buying and selling close to the very best ranges of the yr.

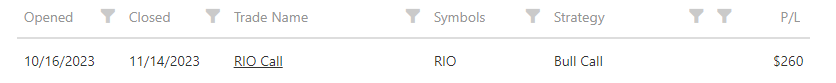

This arrange the commerce suggestion to purchase the RIO January $61.88 calls at $5.10 w.10 discretion.

Quick ahead to November 14 and the technical state of affairs in RIO inventory had modified decidedly. Shares had been now getting overbought as RIO neared overhead resistance at $68. The comparative differential between SLX and RIO had narrowed considerably. As well as, RIO inventory had fallen from A-rated to B-rated. Nonetheless a Purchase, simply not a Robust Purchase. Rio Tinto had additionally fallen to quantity 6 within the Trade from #1.

POWR Choices issued a close-out of the RIO January $61.88 requires $7.70 w.10 discretion. This equates to only over a 50% acquire in slightly below a month. Precise outcomes proven under:

Whereas the inventory had rallied from $64 to $68 in that month timeframe for a acquire of 6.25%, the choices we purchased rose 8 occasions that quantity. Highlights the ability of choices and POWR Choices. Plus, the price of shopping for 100 shares of RIO would have been over $6000. The price of the January name choices was proper round $500-or solely 8% of the fee.

Definitely, not each commerce will work out this effectively or to this diploma. In any case, buying and selling is all about likelihood, not certainty. However utilizing the POWR Choices method might help improve the likelihood of success and put the chances extra in your favor.

POWR Choices

What To Do Subsequent?

In the event you’re searching for the perfect choices trades for at present’s market, it’s best to take a look at our newest presentation The right way to Commerce Choices with the POWR Scores. Right here we present you tips on how to persistently discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you wish to study extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

The right way to Commerce Choices with the POWR Scores

All of the Greatest!

Tim Biggam

Editor, POWR Choices Publication

shares closed at $450.79 on Friday, up $0.56 (+0.12%). Yr-to-date, has gained 19.18%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the complicated world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

Extra…

The submit How We Had been In a position To Steal Some Earnings In Metal Inventory Big RIO appeared first on StockNews.com