The volatility that has turn out to be synonymous with the crypto trade hasn’t deterred establishments from taking part in it, as hedge funds investing in crypto are at an all-time excessive, in accordance with PwC’s 2022 International Crypto Hedge Fund Report.

The annual report surveys each conventional hedge funds and specialist crypto funds to realize a greater understanding of how the comparatively new, however extraordinarily dynamic sector of the trade capabilities.

Crypto hedge funds surge in numbers

PwC’s analysis exhibits there are over 300 crypto-focused hedge funds at the moment available on the market. Whereas some may attribute this development to the maturity of the crypto trade, knowledge from the report means that the launch of latest crypto hedge funds seems to be correlated to the worth of Bitcoin (BTC).

Knowledge confirmed that a lot of funds have been launched in 2018, 2020, and 2021 — all very bullish years for Bitcoin — whereas much less bullish years have seen far more average exercise.

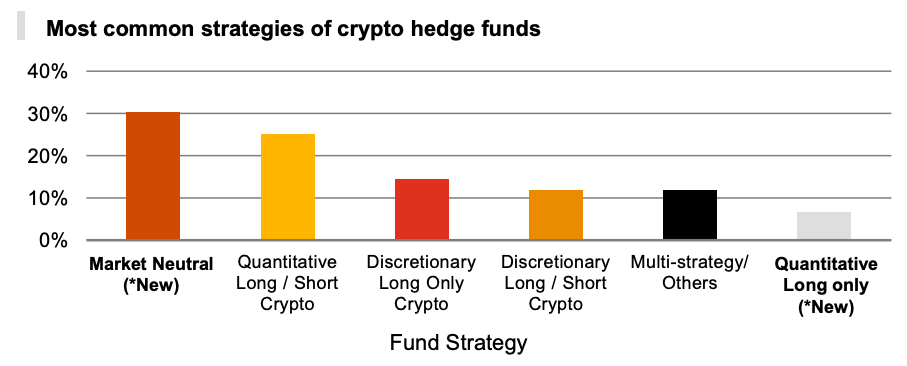

Nevertheless, most new crypto hedge funds normally make use of funding methods that don’t rely available on the market going up. In a survey of over 70 crypto hedge funds, PwC discovered that nearly a 3rd of them employed a market-neutral investing technique. Aiming to revenue whatever the course of the market, these funds normally use derivatives to mitigate danger and get extra particular publicity to the underlying asset.

The second hottest buying and selling technique is a quantitative lengthy and brief technique, the place funds take each lengthy and brief positions based mostly on a quantitative method. Market-making, arbitrage, and low-latency buying and selling are the most typical methods used. Regardless of being widespread amongst hedge funds and offering good returns, these methods limit funds to solely buying and selling extra liquid cryptocurrencies.

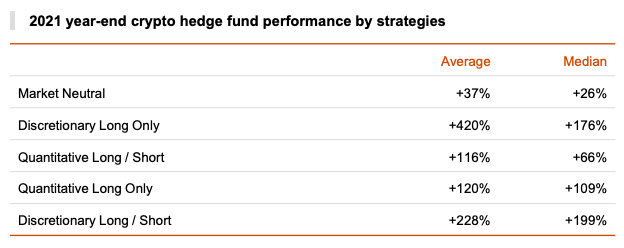

On a median foundation, funds using a discretionary lengthy and brief technique have been the best-performing ones. PwC’s knowledge confirmed that these funds confirmed a median return of 199% in 2021. Wanting on the common return exhibits that discretionary lengthy funds have been the perfect performing ones, exhibiting returns of 420% in 2021. Market impartial funds significantly underperformed funds with different methods, exhibiting a median return of simply 37%.

PwC notes that returns proven by discretionary lengthy and brief funds have been those using a technique that most closely fits the market on the time, as intra-period Bitcoin returns peaked at 131% final 12 months.

Nevertheless, with a median efficiency of 63.4% in 2021, PwC’s pattern of hedge funds was solely in a position to barely outperform Bitcoin’s worth, which elevated by round 60% all year long. And whereas completely different methods yielded completely different ranges of efficiency, all methods in 2021 underperformed when in comparison with 2020.

“The bull market in 2021 didn’t lead to the identical stage of beneficial properties as that of 2020, with BTC growing simply 60% in comparison with about 305% the 12 months earlier than.”

PwC famous that returns aren’t the one worth proposition of hedge funds. What they provide traders is safety in opposition to volatility and the info within the report doesn’t paint an image of whether or not the methods have been in a position to provide greater or decrease volatility in return to cryptocurrencies. Even with low returns, hedge funds that present decrease volatility may very well be extra enticing to traders.

Property below administration on the rise

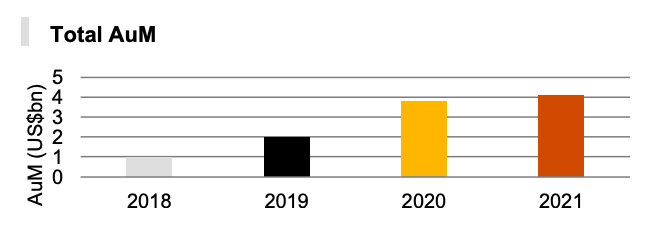

Final 12 months’s sluggish efficiency and excessive market volatility actually haven’t affected the sum of money traders put into hedge funds.

The report estimates that the overall belongings below administration (AuM) of crypto hedge funds elevated by 8% to about $4.1 billion in 2021. The median AuM of crypto hedge funds tripled to $24.5 million in 2021 in comparison with the earlier 12 months, whereas the typical AuM elevated from $23.5 million in 2020 to $58.6 million in 2021.

Managing all of these belongings comes with a value. Identical to conventional hedge funds, crypto funds cost their traders a 2% administration and a 20% efficiency payment.

“One would anticipate crypto hedge fund managers to be charging greater charges given the decrease diploma of familiarity with the product and the upper operational complexity akin to opening and managing wallets – resulting in a much less accessible marketplace for particular person traders, however it appears this has not been the case.”

PwC expects crypto funds to incur greater prices as the general crypto market develops. With regulators world wide demanding greater safety and compliance requirements, crypto hedge funds will more than likely must up their administration charges to maintain worthwhile.

Nevertheless, the 20% efficiency payment may proceed to get decrease within the coming years as extra funds and different establishments start coming into the crypto area. Common efficiency charges decreased from 22.5% to 21.6% p.c in 2021, exhibiting that the rising variety of new funds coming into the area are starting to compete to draw new shoppers.

One of many strategies crypto funds appear to be utilizing to draw shoppers is providing a various funding portfolio. Whereas 86% of the funds mentioned that they’ve invested in “retailer of worth cryptocurrencies” akin to Bitcoin, 78% mentioned that they’ve been investing in DeFi.

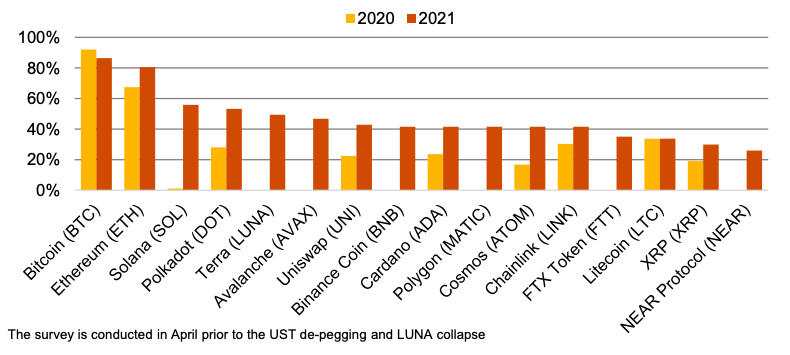

Lower than a 3rd of funds mentioned that half of their day by day buying and selling quantity is in BTC. When in comparison with final 12 months’s 56%, it exhibits that funds are quickly diversifying into altcoins. After BTC and Ethereum (ETH), the highest 5 altcoins crypto hedge funds traded have been Solana (SOL), Polkadot (DOT), Terra (LUNA), Avalanche (AVAX), and Uniswap (UNI).

It’s nonetheless unclear how the de-pegging of TerraUSD (UST) and the following collapse of LUNA affected these funds, as PwC’s survey was carried out in April earlier than these occasions occurred. The corporate believes that we’ll see capital inflows into the crypto market decelerate for the rest of the 12 months as traders turn out to be extra cautious.

“Many funds have but to put up their Could 2022 returns and it’ll solely be as soon as these are out that it will likely be potential to guage the impression of the Terra collapse and the broader downturn in crypto markets. In fact, there may even be funds that already had a bearish outlook or have been in a position to modify and determine the problems at Terra higher, managing their exposures and even taking brief positions over this era. Corrections are to be anticipated. The market has recovered earlier than and there’s no motive to consider it gained’t rebound once more,” John Garvey, the worldwide monetary companies chief at PwC, informed CryptoSlate.

PwC believes that the warning will unfold to stablecoins as effectively. Along with altcoins, stablecoins have additionally considerably grown in reputation amongst hedge funds. The 2 largest stablecoins by way of utilization have been USDC and USDT, with 73% and 63% of funds utilizing them, respectively. Just below a 3rd of crypto funds reported utilizing TerraUSD (UST) within the first quarter of the 12 months.

“It’s attention-grabbing to notice that regardless of USDT’s market capitalization being nearly double that of USDC, hedge funds appear to favor utilizing USDC. We consider that is because of the higher transparency provided by USDC across the belongings backing the stablecoin.”

The rise in stablecoin utilization may very well be defined by an analogous improve in the usage of decentralized exchanges. In keeping with PwC’s report, 41% of crypto funds reported utilizing DEXs. These dabbling in DeFi appear to flock to Uniswap, as knowledge confirmed that 20% of funds used the platform as their most well-liked DEX.

Bullish on Bitcoin

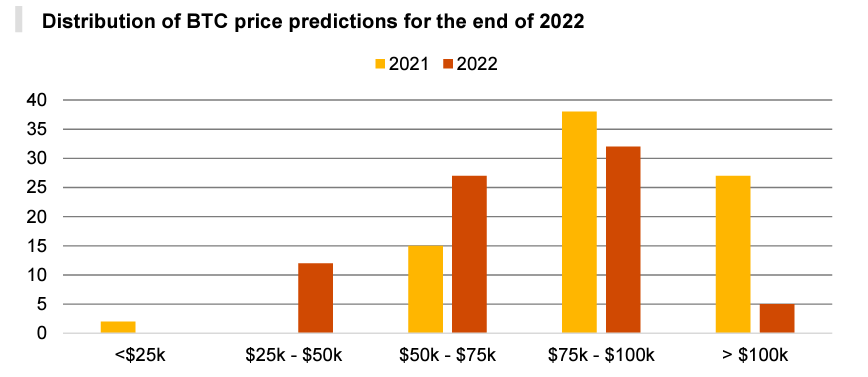

Regardless of the market being fairly bearish on the time PwC’s survey was carried out, most crypto funds remained bullish on Bitcoin. When requested to present their estimate on the place the worth of BTC shall be on the finish of the 12 months, the bulk (42%) put it within the $75,000 to $100,000 vary. One other 35% predicted it will vary between $50,000 and $75,000.