A brand new report from Morgan Stanley has revealed that if Ethereum switches to a proof-of-stake (PoS) consensus as deliberate, it should dispose of the necessity for miners, lowering the demand for graphics processing items (GPUs), and considerably decrease power wants.

Ethereum Miners May Discover Options, Says Morgan Stanley

GPU utilization could lower if Ethereum switches from a proof-of-work methodology to a proof-of-stake one by the Merge of the Beacon Chain with the ETH mainnet.

Sheena Shah, an fairness strategist at Morgan Stanley, says that the much less energy-intensive proof-of-stake will lead to a decline available in the market for GPU miners. The report learn:

and Ethereum at the moment require highly effective computer systems for the mining course of and devour numerous power which governments and regulators are more and more involved over. If Ethereum strikes to utilizing Proof-of-Stake (PoS) it should remove the necessity for miners (lowering demand for GPUs) and drastically cut back power necessities.”

The financial institution claimed that over the earlier 18 months, crypto mining has considerably impacted the gaming graphics enterprise, driving an anticipated 14% of income in 2021 whereas “considerably contributing to a serious graphic scarcity, which boosted total combine and pricing.”

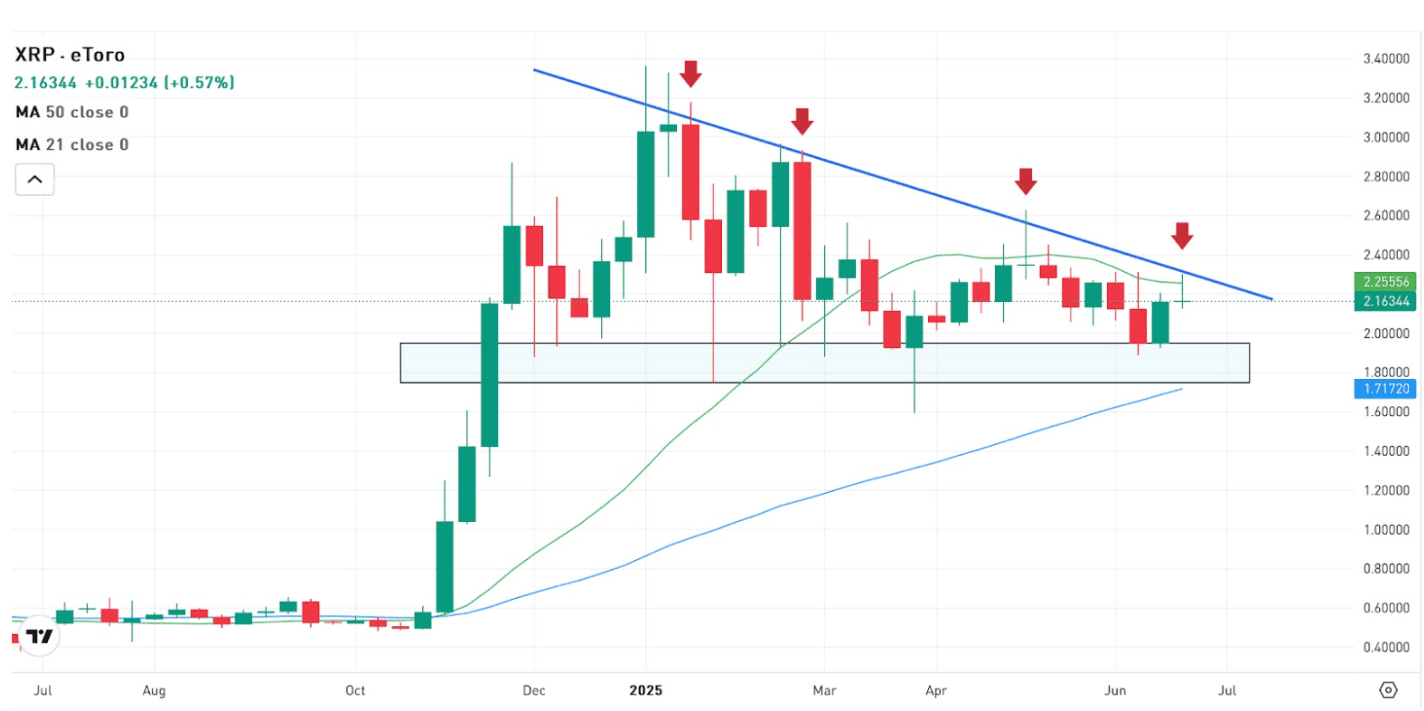

ETH/USD trades at $1,200. Supply: TradingView

The report said that though GPU demand may lower, chip producer Nvidia is much less depending on the demand for cryptocurrency mining than it was in 2017–19.

The financial institution additionally noticed that within the first half of the yr, demand for graphics playing cards from crypto mining, which contributed to the shortfall, began to say no. This was because of the market decline in cryptocurrencies.

Nonetheless, it was predicted in a distinct evaluation by Bloomberg in mid-June that Ethereum miners would possible proceed mining till the Merge takes place later this yr. Moreover, some miners considered switching their Ethereum miners to mine Revencoin or Ethereum Traditional.

GPU Producers Say They Have Managed Downsides

Nvidia and AMD (AMD) have each maintained that they’ve decreased the chance of cryptocurrency-related draw back eventualities, however Morgan Stanley believes {that a} decline in gaming GPU costs will happen within the first quarter of 2023. This shall be attributable to various causes, together with a decline in work-from-home exercise, the migration of cryptocurrencies to point-of-sale methods, and “powerful sequential comps after channel stock rebuild in 2022,” in keeping with the report.

The financial institution said that since it’s at the moment unprofitable for all of those computer systems to mine different cryptocurrencies after the Merge, Ethereum miners will possible promote their used GPU gear. The financial institution additionally said that since web ether (ETH) provide is anticipated to say no after the Merge and should even flip contractionary, it’s unlikely that the entire miners will swap to staking.

The report additionally said that switching to PoS is not going to deal with Ethereum’s scalability points, together with its poor transaction throughput or transaction prices.

Associated studying | Ethereum Hashrate Plunges Over 10% As Mining Profitability Drops

Featured picture from Pixabay, chart from TradingView.com