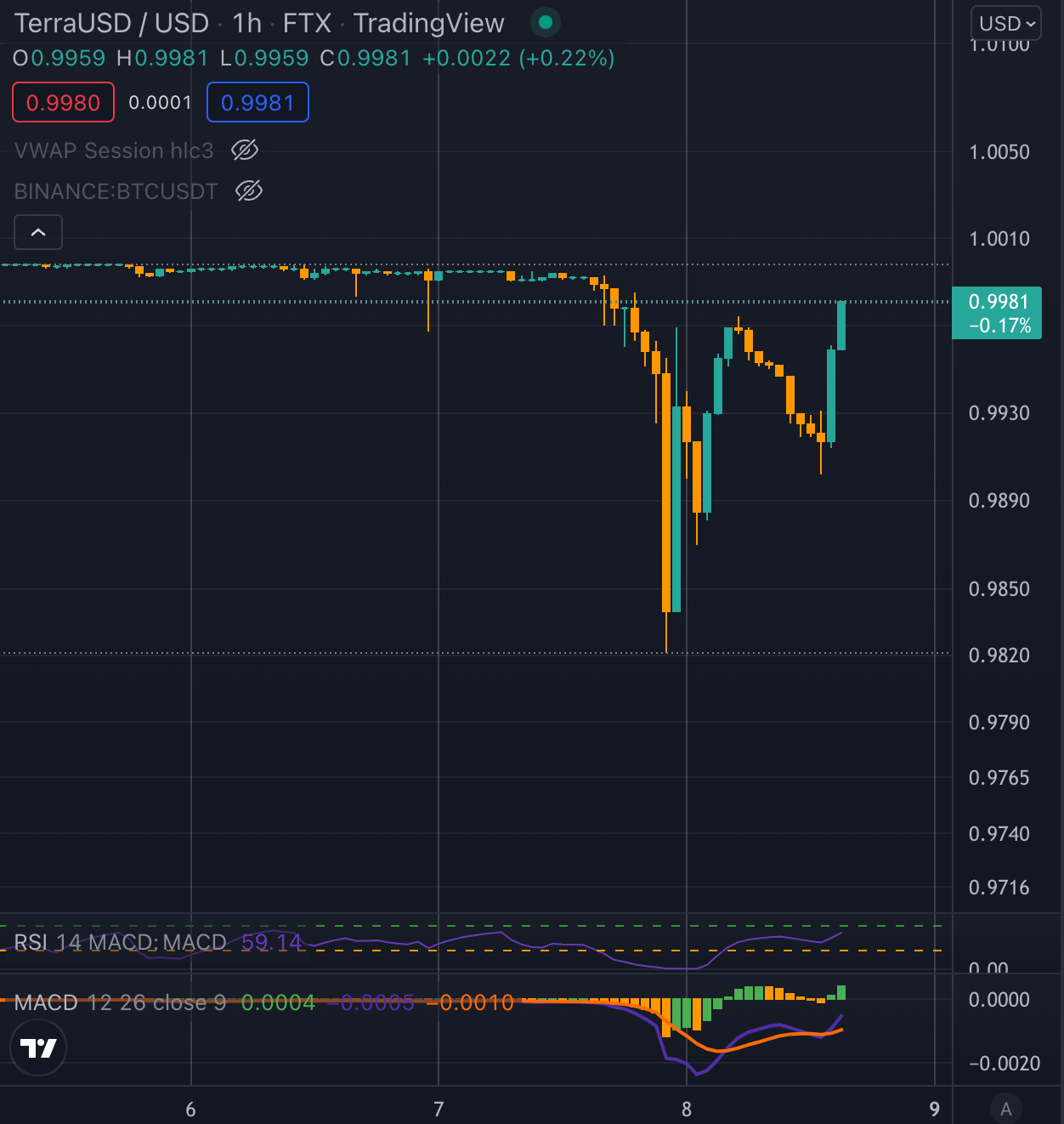

A seemingly coordinated assault on the Terra ecosystem occurred this weekend, Might seventh, as a whole lot of hundreds of thousands of {dollars} price of UST was dumped on Curve Finance. This occurred in tandem with a rise briefly curiosity in Terra Luna and a surge in Twitter quantity that led to “Ponzi” trending globally for just a few hours.

A number of accounts on Crypto Twitter posted tweets with screenshots of the second UST dropped under $0.992 as breaking information that the greenback peg had damaged down. Some even declared it a “second in historical past.”

₿REAKING – TerraUSD greenback peg breaks down. In free fall after Luna hundreds up on #Bitcoin. pic.twitter.com/jvOcD4QKeb

— Dennis Porter (@Dennis_Porter_) May 8, 2022

The monumental de-pegging nonetheless was seemingly short-lived as the present value for UST on Binance reveals.

The buying and selling quantity on Curve soured to 3 occasions that of Uniswap as “somebody began promoting UST en masse, so it began to de-peg. Nevertheless, that was met with a terrific resistance, so the peg was restored,” in keeping with a statement from Curve.

DegenSpartan was one of many first to notice the problems on Curve in addition to spotlight a $2 billion drop in locked property on Anchor from $14B to $11.7B. For the reason that tweet, it has dropped even additional within the steepest decline since January. Two wallets, particularly, withdrew a complete of $372 million from Anchor in at some point.

Do Kwon, replied to the occasions by saying, “Btw, if yall women are gonna fud, attempt to do it throughout my waking hours pls. Terra chain is 24/7, however I’m a brand new father for cryin out loud.” He additionally retweeted the next,

as we speak’s assault on Terra-Luna-UST was deliberate and coordinated. Large 285m UST dump on Curve and Binance by a single participant adopted by large shorts on Luna and a whole lot of twitter posts. Pure staging. The mission is bothering somebody. ? on the proper path!

— Caetano Manfrini ?? (@CaetanoManfrini) May 8, 2022

Some have seen this as a profitable stress check on the community exhibiting that even dramatic volatility solely moved the peg down 0.7% earlier than the algorithm handled the decline. Elementary analyst, CryptoHarry commented,

The dangerous actors knew as we speak was their final probability to de-peg $UST, proper earlier than the incentives for 4pool go reside. No respectable vendor would promote 500m $UST whereas liquidity is shifting from 3pool to 4pool. Is not sensible.

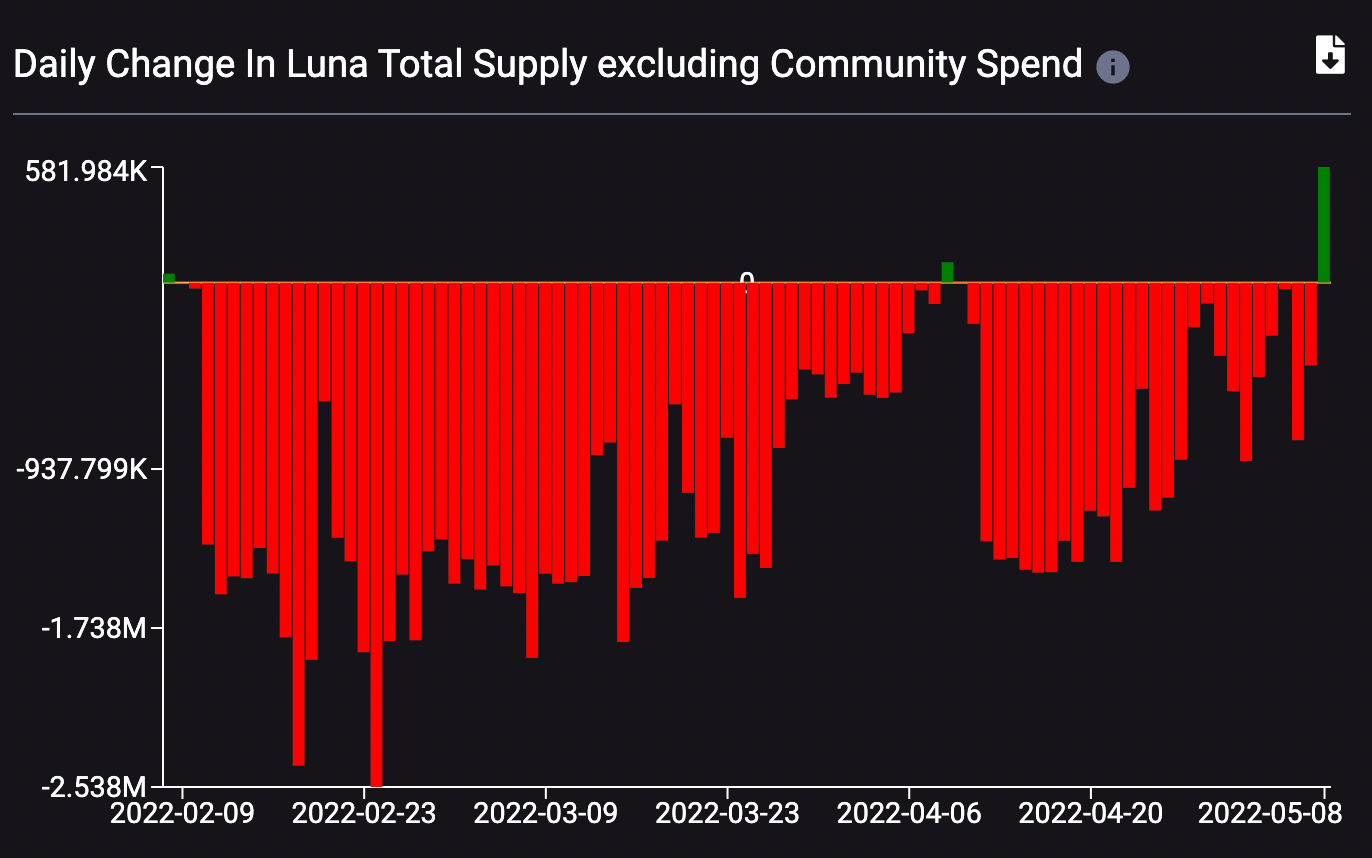

As a knock-on impact, the overall provide of LUNA made its first vital improve in months on account of the exercise with 581,984 LUNA being minted. This will probably be, partially, liable for the decline within the value of LUNA over the previous 24 hours. The worth hit $59 earlier than rebounding barely to round $66. On the backside, LUNA had fallen 25% amid the UST chaos.

Was this a concerted assault or did traders merely withdraw organically as yield dropped? Did the Crypto Twitter onslaught of negativity trigger a snowball impact? The knowledge continues to be being parsed however, a minimum of for now, TerraUSD continues to be the third largest stablecoin by market cap on the planet. A researcher from Alongside DeFi summarized the occasions within the following tweet,

Looks as if that is what occurred:

-Large $UST sell-off on Curve

-Rumors spreading shortly on Twitter

-Results in a $2B withdrawal of $UST on Anchor

-Value of $LUNA tanks

– $UST depeg to 0.987

-Peg straight as much as 0.995 after Do Kwon tweet

-Bounce promoting property to purchase $UST— Route 2 FI (@Route2FI) May 8, 2022