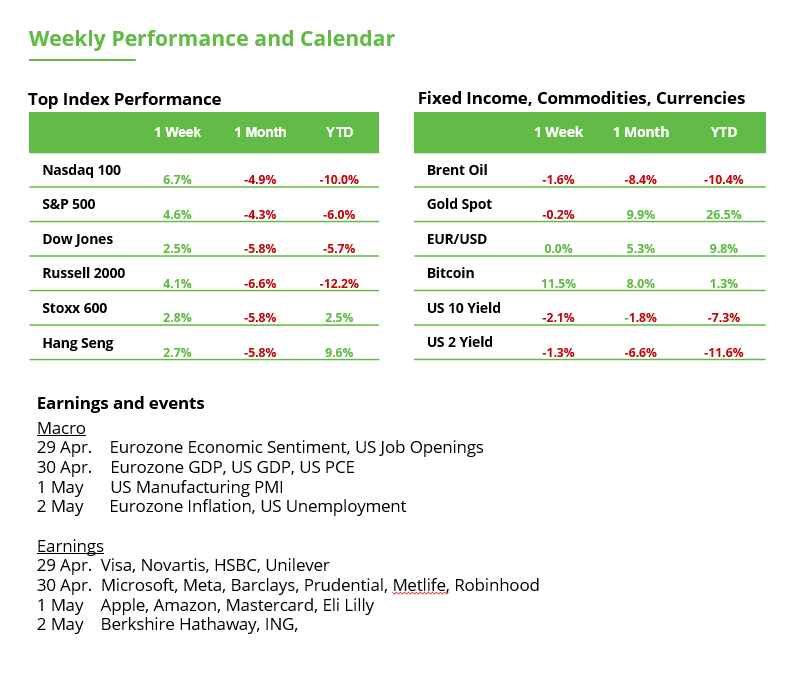

Markets faced a whirlwind of tariffs, CEO warnings, and Big Tech reality checks last week. Policy shifts and earnings set the stage for what’s next – and all eyes are now on the tech giants ready to report. Here’s what investors need to know heading into a critical stretch.

Tariff Pressures Eased After CEO Warnings:

After market turmoil, falling polling numbers, and warnings from the CEOs of Walmart, Target, and Home Depot about higher prices and empty shelves due to tariffs, the US has made a series of concessions that demonstrate there is now an effort to turn down the temperature on tariffs. Investors are adjusting portfolios, with consumer, retail, and industrial sectors likely to benefit if trade tensions stay contained. While a full US- China deal is not done, the shift lowered the temperature for now- a reminder that policy risk remains a swing factor for markets worldwide.

Mega-Cap Tech’s Reality Check: The once-invincible Magnificent 7 tech giants are coming back to earth. Their earnings growth is still outpacing the rest of the S&P, but by a far slimmer margin heading into 2025-26. AI & Software – Silver Lining: One clear bright spot amid the uncertainty is the continued boom in AI and enterprise software. From cloud computing to generative AI, tech leaders are doubling down on innovation to drive efficiency and new revenue streams. This week’s Big Tech earnings are expected to hammer this home, which can showcase AI prowess and resilient software demand. For investors, the message is that long-term tech themes (AI, cloud) remain intact – even if the macro winds blow cold in the short term.

Big Tech Earnings Bonanza Upcoming: This week brings a tech earnings bonanza that could set the market tone. Four of the five largest US tech firms report this week: Meta and Microsoft on April 30, and Apple and Amazon on May 1. All eyes will be on their results and guidance – especially any commentary on cloud spending, digital ads, and AI initiatives. Investors will be looking for confirmation that innovation and cost discipline can counterbalance any economic softness.

Key focus areas:

- Cloud Spending: AWS, Azure, and Google Cloud results will show how IT budgets are evolving in a more cautious economy.

- AI Commercialization: Progress on AI product rollouts and monetization will be critical for market sentiment.

- Consumer Demand Signals: Apple’s iPhone and services growth will be a major read on discretionary spending resilience.

- Advertising Trends: Meta and Google will provide insight into small and mid-sized business marketing budgets – a leading indicator for broader economic health.

Top 3 Themes to Watch for:

- Tariff De-escalation = Retail and Consumer Relief: Trade concessions could ease pressure on supply chains and margins.

- Software and AI = Relative Strength:Software and AI adoption trends are strong, even against macro headwinds.

- Big Tech Earnings = Market Catalyst: Forward guidance will shape risk appetite across sectors, not just in technology.

Between tariff policy and economic data – investors need strong nerves

The calendar is packed with important updates: Recent weeks have clearly shown how sensitive markets are to new headlines, which can lead to sharp short-term moves. In uncertain times, macro data and earnings season provide real-world insights beyond speculation.

The Fed’s preferred inflation gauge: The Core PCE Price Index remains clearly above the central bank’s 2% target, currently sitting at 2.8%. The key will be whether the March data, due Wednesday, show a meaningful decline. The ISM Manufacturing PMI, due Thursday, is expected to fall from 49.0 to 47.9. That would signal weakening industrial activity and could support expectations for rate cuts – provided inflation continues to ease and Friday’s labor market data also come in weak.

Germany remains Europe’s weak spot: Inflation and GDP data from Europe on Wednesday will particularly highlight Germany. The region’s largest economy has been in recession for two years. The German government expects stagnation at best in 2025. And yet, the DAX keeps reaching new record highs. The reason: DAX-listed companies generate 82% of their revenue abroad. The stock market therefore reflects global growth, not the domestic German economy.

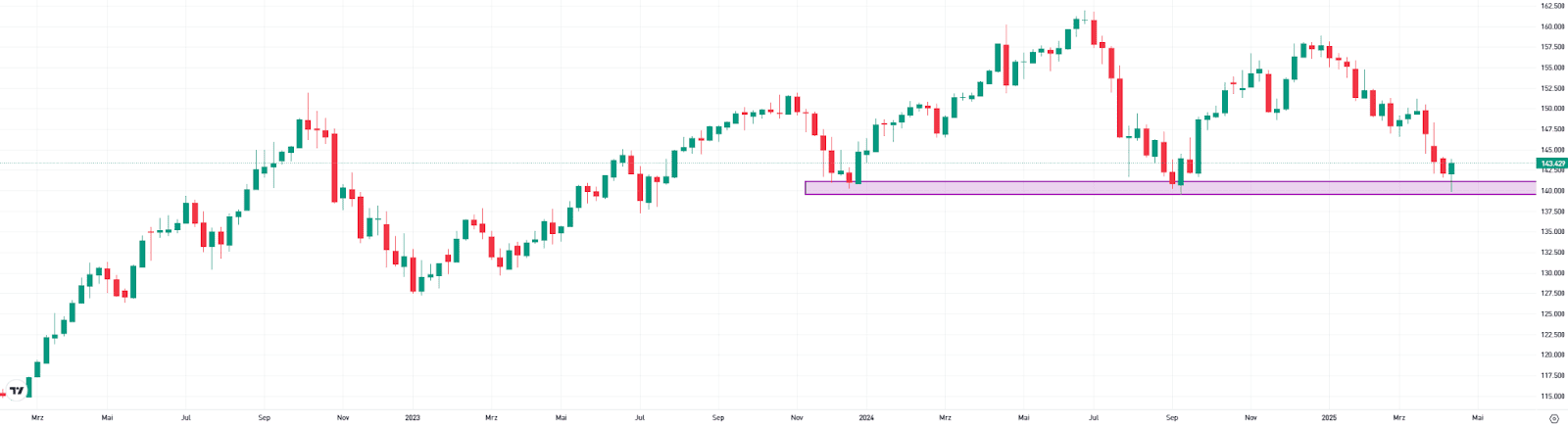

Japan: Unlike most other central banks, the Bank of Japan is currently in a rate-hiking cycle. However, it is expected to hold rates steady on Thursday. Traders will be watching closely to see whether further rate hikes might be delayed or whether there is imminent need for action. A hawkish tone would likely support the yen further. The USD/JPY pair has fallen by 8% over the past three months and tested long-term support around 140 last week (see chart).

Bottomline: Given the flood of data from the US and Europe, there could be plenty of short-term trading opportunities in EUR/USD. The pair has been trading in a narrow range between 1.13 and 1.14 in recent days. Interest rate-sensitive sectors such as technology, financials, and real estate could react particularly strongly to changes in rate expectations. For USD/JPY, we may soon see whether a long-term trend shift is underway.

USD/JPY

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.